Navigating Bank Holidays In India: A Comprehensive Guide For 2025

Navigating Bank Holidays in India: A Comprehensive Guide for 2025

Related Articles: Navigating Bank Holidays in India: A Comprehensive Guide for 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating Bank Holidays in India: A Comprehensive Guide for 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Bank Holidays in India: A Comprehensive Guide for 2025

Understanding the nuances of bank holidays in India is crucial for individuals and businesses alike. These holidays, observed across the country, impact financial transactions, business operations, and daily routines. This comprehensive guide provides a detailed overview of bank holidays in India for 2025, explaining their significance and offering practical insights for effective planning.

Understanding the Significance of Bank Holidays

Bank holidays in India are designated days when banks remain closed for official purposes. These holidays are typically observed to commemorate national festivals, religious occasions, and significant historical events. While these days offer opportunities for relaxation and celebration, they also have practical implications for financial transactions and business activities.

Types of Bank Holidays in India

Bank holidays in India can be categorized as follows:

- National Holidays: These are observed nationwide and typically commemorate important national events like Independence Day (August 15th) and Republic Day (January 26th).

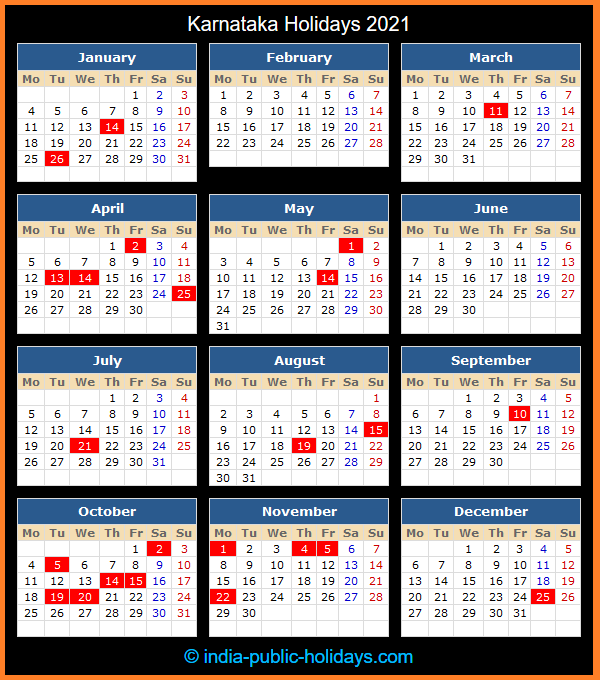

- State Holidays: These are specific to individual states and often reflect regional festivals or cultural celebrations.

- Bank Holidays: These are declared by the Reserve Bank of India (RBI) and are observed by all banks across the country.

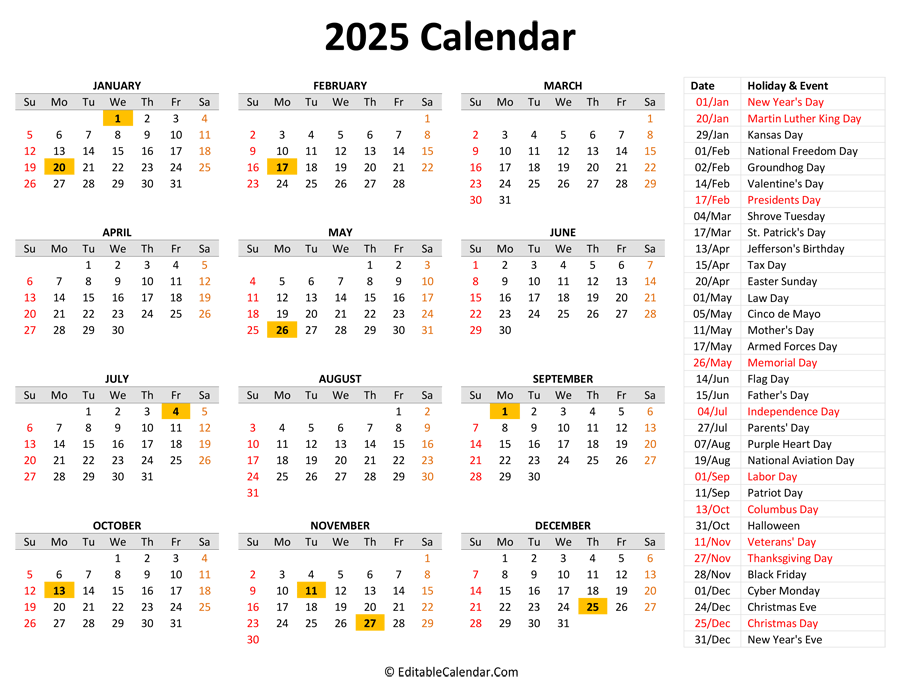

Bank Holidays in India for 2025: A Detailed Calendar

The following calendar provides a comprehensive list of bank holidays in India for 2025, categorized by their type:

January

- January 1st: New Year’s Day (National Holiday)

- January 26th: Republic Day (National Holiday)

February

- No Bank Holidays

March

- Holi (Date varies based on lunar calendar): Festival of Colors (Observed as a holiday in various states)

April

- Good Friday (Date varies based on the Gregorian calendar): Christian religious holiday (Observed as a holiday in various states)

- Ram Navami (Date varies based on the lunar calendar): Birth of Lord Rama (Observed as a holiday in various states)

May

- May 1st: Labour Day (National Holiday)

- Buddha Purnima (Date varies based on the lunar calendar): Birth, enlightenment, and death anniversary of Buddha (Observed as a holiday in various states)

June

- No Bank Holidays

July

- No Bank Holidays

August

- August 15th: Independence Day (National Holiday)

September

- Ganesh Chaturthi (Date varies based on the lunar calendar): Birth of Lord Ganesha (Observed as a holiday in various states)

October

- Dussehra (Date varies based on the lunar calendar): Victory of good over evil (Observed as a holiday in various states)

- Gandhi Jayanti (October 2nd): Birth anniversary of Mahatma Gandhi (National Holiday)

November

- Diwali (Date varies based on the lunar calendar): Festival of Lights (Observed as a holiday in various states)

- Guru Nanak Jayanti (Date varies based on the lunar calendar): Birth anniversary of Guru Nanak (Observed as a holiday in various states)

December

- Christmas Day (December 25th): Christian religious holiday (Observed as a holiday in various states)

Important Notes:

- The dates of some holidays, particularly those based on the lunar calendar, may vary slightly each year.

- This list is not exhaustive and may not include all state holidays. It is always advisable to consult official sources for accurate and up-to-date information.

FAQs on Bank Holidays in India

Q: Are all banks closed on bank holidays?

A: While most banks remain closed on bank holidays, some may offer limited services or operate with reduced staff. It is always advisable to contact the specific bank for confirmation.

Q: How do bank holidays affect financial transactions?

A: On bank holidays, most financial transactions, including ATM withdrawals, online banking, and cheque clearing, are usually suspended. This can impact business operations and personal finances.

Q: Are there any exceptions to the bank holiday rule?

A: In some cases, banks may remain open for specific services, such as foreign exchange transactions or emergency banking. It is recommended to contact the bank directly for clarification.

Q: What should I do if I need to access banking services on a bank holiday?

A: It is advisable to plan ahead and complete any necessary banking transactions before the holiday. In case of emergencies, contacting the bank’s customer service hotline may provide assistance.

Tips for Managing Bank Holidays

- Plan Ahead: Review the bank holiday calendar and anticipate potential disruptions to your financial plans.

- Check with Your Bank: Contact your bank to confirm their operating hours and services available during holidays.

- Make Advance Arrangements: Complete necessary transactions, such as bill payments or fund transfers, before the holiday.

- Stay Informed: Monitor official announcements from the RBI and your bank for any updates or changes to holiday schedules.

- Use Alternative Services: Consider using online banking, mobile banking, or ATMs for essential transactions during holidays.

Conclusion

Navigating bank holidays in India requires careful planning and awareness. By understanding the significance of these holidays and the impact they have on financial transactions, individuals and businesses can effectively manage their operations and ensure smooth financial flow. Staying informed about the latest holiday schedules and utilizing available resources can significantly mitigate potential disruptions and ensure a seamless banking experience.

Closure

Thus, we hope this article has provided valuable insights into Navigating Bank Holidays in India: A Comprehensive Guide for 2025. We hope you find this article informative and beneficial. See you in our next article!